Cant Miss Takeaways Of Tips About How To Create An Invoice Bill

Understanding the Importance of a Well-Crafted Invoice Bill

1. Why Bother with a "Fancy" Invoice?

Okay, let's face it, nobody loves paperwork, especially when it comes to billing. But hear me out: a well-designed invoice bill isn't just about getting paid (although that's a HUGE part of it!). It's also a reflection of your professionalism and can significantly impact client relationships. Think of it as your final impression after delivering a stellar product or service. A clear, concise, and even visually appealing invoice shows you're organized, detail-oriented, and value their business. It also makes THEIR lives easier, leading to faster payments and fewer headaches for everyone involved. Who doesn't want that?

Beyond the warm fuzzies of good customer service, a detailed invoice bill can also protect you legally. Should any payment disputes arise (and let's hope they don't!), a well-documented invoice acts as proof of the agreement, services rendered, and the agreed-upon price. It's like having a friendly little contract reminding everyone of the deal.

Moreover, proper invoicing helps with your own financial tracking. Accurately recorded invoices give you a clear picture of your income, outstanding payments, and overall business health. This is essential for budgeting, forecasting, and, yes, even those dreaded tax returns. So, while it might seem like a minor detail, mastering the art of the invoice bill is actually a crucial step in running a successful and sustainable business. Trust me, future you will thank you.

Finally, consider the branding opportunity! While not every invoice needs to be a work of art, incorporating your logo and brand colors can reinforce your identity and make your business more memorable. It's a subtle way to stay top-of-mind and reinforce your brand image with every transaction. So, even a simple invoice can contribute to building a stronger and more recognizable brand. Think of it as a mini billboard for your business, delivered right to your client's inbox.

Key Components of a Killer Invoice Bill

2. The Anatomy of a Perfect Payment Request

So, what exactly goes into creating an invoice bill that's both effective and professional? It's not rocket science, but there are definitely some key elements you need to include. Let's break it down:

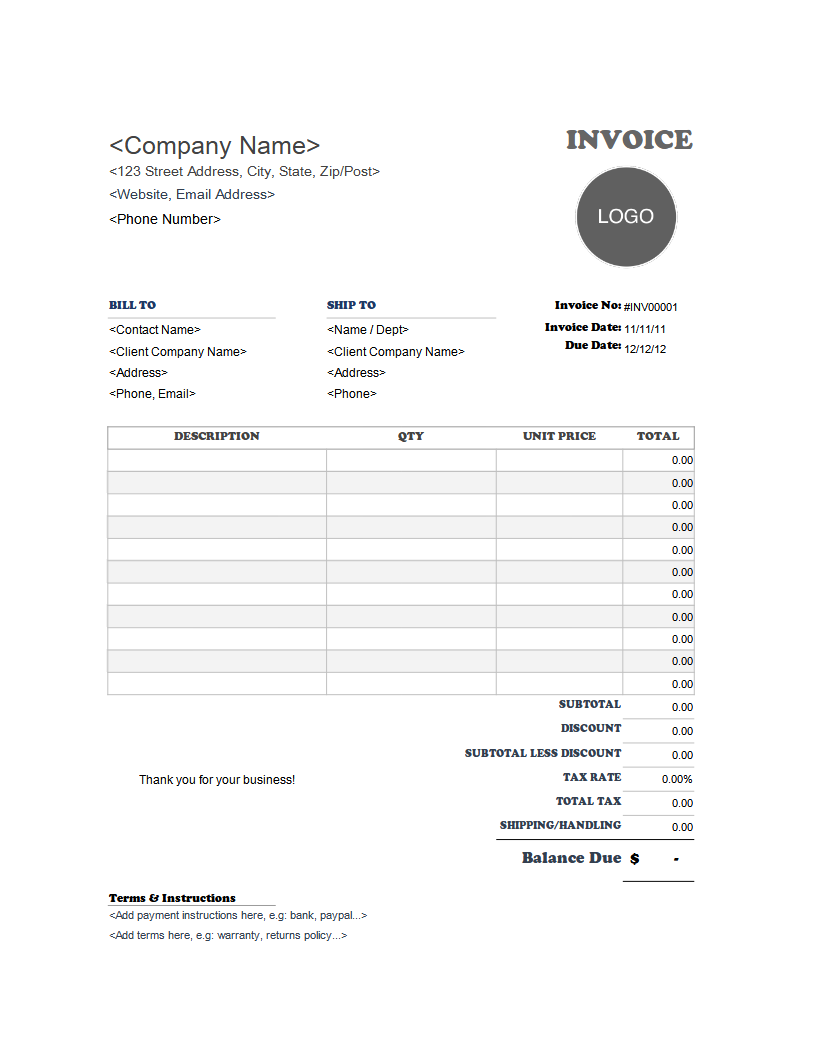

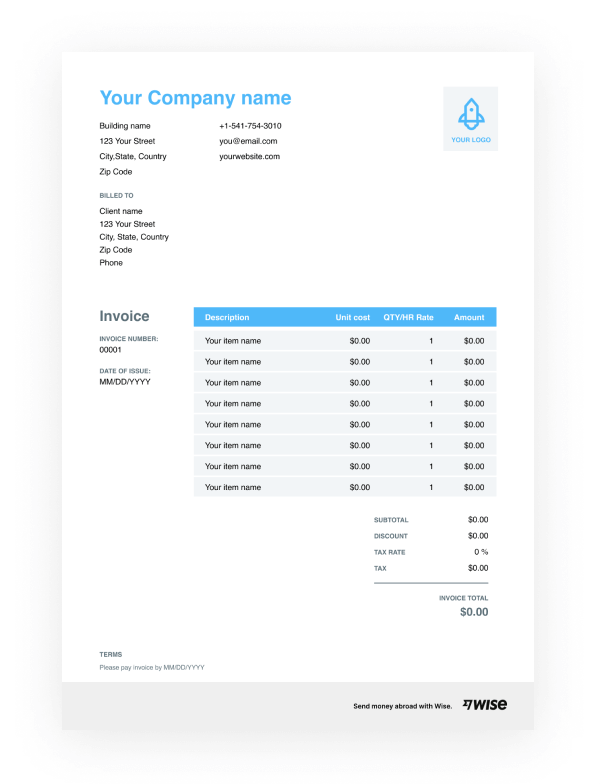

First and foremost, you'll need a unique invoice number. This helps you track your invoices, avoid duplicates, and easily reference specific transactions. A simple sequential numbering system (e.g., 001, 002, 003) works perfectly well. Include your business name, address, and contact information. This makes it easy for your clients to reach you if they have any questions. Also include your client's name and address, too. This is important for record-keeping and ensuring the invoice reaches the right person.

Next up, the invoice date is crucial for tracking payment timelines and managing accounts receivable. Don't forget to specify a clear payment due date. Be realistic about how long you're willing to wait for payment and make sure it's clearly stated on the invoice. A detailed description of the products or services provided is essential. Be specific and avoid vague terms. The more detail you provide, the less room there is for confusion or disputes.

The total amount due, including any applicable taxes or discounts, should be prominently displayed. Calculate everything carefully to avoid errors. It's also good practice to list each item with it's individual cost before taxes and adding everything up to the final cost. Finally, specify your preferred payment methods (e.g., credit card, bank transfer, check). Make it as easy as possible for your clients to pay you!

Printable Invoice Receipt

Step-by-Step Guide to Creating Your Invoice Bill

3. From Zero to Paid

Alright, now that we know what goes into a great invoice bill, let's walk through the actual creation process. You've got a few options here, depending on your needs and budget.

Option 1: Invoice Templates. If you're just starting out or don't need a lot of bells and whistles, using a free invoice template is a great option. There are tons of templates available online (think Google Docs, Microsoft Word, or dedicated invoice template websites). Simply download a template, customize it with your information, and you're good to go. The downside is that you'll have to manually track payments and manage your invoices.

Option 2: Online Invoice Generators. Online invoice generators are a step up from templates. They offer more customization options and often include features like automatic invoice numbering, payment reminders, and basic reporting. Many of these tools are free or offer affordable monthly subscriptions. They can save you time and effort compared to manual invoice creation, but they may not be as comprehensive as full-fledged accounting software.

Option 3: Accounting Software. For businesses with more complex needs, investing in accounting software like QuickBooks, Xero, or FreshBooks is a smart move. These platforms offer comprehensive invoice management features, including automated invoicing, payment tracking, expense tracking, and financial reporting. While they come with a higher price tag, they can streamline your entire accounting process and save you valuable time in the long run. Choose the option that best suits your business needs and budget. No matter which method you choose, always double-check your invoice for accuracy before sending it to your client.No matter which method you pick, make sure to proofread it before sending it out. Spelling errors, wrong numbers, or a poorly-written description can reflect poorly on your business. Treat your invoices like you would any other important document — with care and attention to detail!

How To Create A Invoice Template In Excel

Optimizing Your Invoice Bill for Faster Payments

4. Tips and Tricks to Get Paid On Time

Creating a great invoice bill is only half the battle. The real goal is to get paid quickly and consistently. Here are some tips to help you speed up the payment process:

First, send your invoice promptly! Don't wait weeks or months to bill your clients. The sooner they receive the invoice, the sooner they're likely to pay it. Make sure the due date is clearly stated on the invoice. Avoid vague language like "Net 30" and specify an exact date. Offer multiple payment options to make it as easy as possible for your clients to pay you. Consider accepting credit cards, bank transfers, online payment services like PayPal, and even checks (if appropriate for your business).

Follow up on overdue invoices. Don't be afraid to send friendly reminders. A simple email or phone call can often do the trick. Consider offering early payment discounts to incentivize clients to pay you sooner. A small discount (e.g., 2% off if paid within 10 days) can be a surprisingly effective motivator.

Clearly outline your payment terms in advance. Make sure your clients understand your payment policies before you begin working together. This can help prevent misunderstandings and ensure everyone is on the same page. And, if all else fails, consider using an invoice factoring service or a collections agency to recover unpaid debts. This should be a last resort, but it's an option to consider if you're struggling to get paid.

Above all, maintain open communication with your clients. If you anticipate any delays in payment, let them know in advance. Building strong relationships with your clients can go a long way in ensuring timely payments. A little proactive communication can prevent a lot of headaches!

FAQ

5. Your Burning Invoice Questions Answered

Still have questions about invoice bills? You're not alone! Here are some frequently asked questions (and hopefully, helpful answers):

Q: Do I really need to include an invoice number? Can't I just skip it?

A: While not strictly legally required in all cases, invoice numbers are highly recommended. They help you track your invoices, prevent duplicates, and easily reference specific transactions. Trust us, you'll thank yourself later!

Q: What happens if I make a mistake on an invoice?

A: Don't panic! Simply issue a credit memo to correct the mistake and then send a new, corrected invoice. Be sure to clearly reference the original invoice number and the credit memo number on the new invoice.

Q: How long should I keep copies of my invoices?

A: The general rule of thumb is to keep copies of your invoices (both sent and received) for at least seven years. This is important for tax purposes and in case of any audits.

Q: Is it okay to send invoices as PDFs?

A: Absolutely! PDFs are a widely accepted and professional way to send invoices. They ensure that the formatting remains consistent regardless of the recipient's operating system or software.